Well this page is aimed to give you a complete understanding on how it works and what you need to understand to choose the products that suits you the best. As at every life stage, everyone has a set of primary needs that requires sufficient funds to fulfill them. This is where life insurance comes into the picture- as it offers tailor made products to cover every aspect at different stages of life.

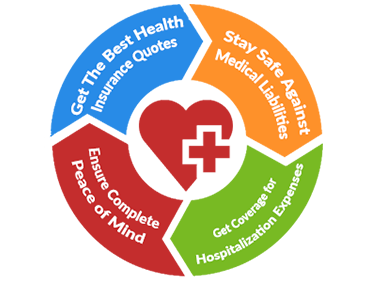

Why A Health Plan? In today’s fast paced lives that we live and in a race to excel in everything, we forget one of the most important asset we own I.e our health. Due to various habits & changing lifestyles, health related concerns have just become increasingly alarming. We may not be able to go back and slow down the pace of our lives, but can definitely guard ourselves from its side effects. Here’s when an efficient health cover comes handy so that any sudden illness doesn’t derail our financial freedom. Medical assistance comes with a price tag, such that people are forced to sell of their assets or rely on borrowers to meet the expenses. Such unforeseen events can be easily dealt with a strong health insurance plans. So guard your finances by opting for complete protection for you & your family by getting adequate health cover as per your requirements

Why Personal Accident Insurance? Looking for Investing in a Life Insurance product? But not sure exactly how it works? Mutual funds are managed by professional people who have years of experience handling different types of assets. They are a group of dedicated fund managers that handles all financial decisions based on the performance & prospects available in the market.

International Travel Insurance professional people who have years of experience handling different types of assets. They are a group of dedicated fund managers that handles all financial decisions based on the performance & prospects available in the market.

Corporate Travel Insurance who have years of experience handling different types of assets. They are a group of dedicated fund managers that handles all financial decisions based on the performance & prospects available in the market.

What is Auto Insurance? Auto insurance policy is mandatory for vehicle owners as per Indian Motor Vehicles Act 1988. This Plan is designed to give coverage for losses which insured might incur in case his gets stolen or damaged. The amount of Auto insurance premium is decided based on the Insured Declared Value of a car. The premium will increase, if you raise the IDV limit and vice versa.

Life insurance is of significant importance if you wish to protect your family or dependents from any economic hardship in your absence.

Mutual funds are managed by professional people who have years of experience handling different types of assets. They are a group of dedicated fund managers that handles all financial decisions based on the performance & prospects available in the market.

Mutual funds are managed by professional people who have years of experience handling different types of assets. They are a group of dedicated fund managers that handles all financial decisions based on the performance & prospects available in the market.

Mutual funds are managed by professional people who have years of experience handling different types of assets. They are a group of dedicated fund managers that handles all financial decisions based on the performance & prospects available in the market.

Systematic Investment Plan (SIP) is a very easy & convenient mode of making investments in mutual funds on a regular basis. SIP allows one to cultivate a habit of savings & creating wealth for the future by starting early. Offering ease & flexibility, through SIP one can create a planned approach towards investing right. SIP gets auto-debited from the investors account and the amount is invested into a mutual fund scheme that has been specified. The investor then gets a certain number of units which is based on the current ongoing market rate. Every-time a SIP is made, additional units keep getting added to the investor’s account. SIP has proved to be an ideal choice of investments for retail investors who lack resources to pursue active investments.

Systematic Investment Plan (SIP) is a very easy & convenient mode of making investments in mutual funds on a regular basis. SIP allows one to cultivate a habit of savings & creating wealth for the future by starting early. Offering ease & flexibility, through SIP one can create a planned approach towards investing right. SIP gets auto-debited from the investors account and the amount is invested into a mutual fund scheme that has been specified. The investor then gets a certain number of units which is based on the current ongoing market rate. Every-time a SIP is made, additional units keep getting added to the investor’s account. SIP has proved to be an ideal choice of investments for retail investors who lack resources to pursue active investments.