Well this page is aimed to give you a complete understanding on how it works and what you need to understand to choose the products that suits you the best. As at every life stage, everyone has a set of primary needs that requires sufficient funds to fulfill them. This is where life insurance comes into the picture- as it offers tailor made products to cover every aspect at different stages of life.

Looking for Investing in a Life Insurance product? But not sure exactly how it works? Mutual funds are managed by professional people who have years of experience handling different types of assets. They are a group of dedicated fund managers that handles all financial decisions based on the performance & prospects available in the market.

Looking for Investing in a Life Insurance product? But not sure exactly how it works? Mutual funds are managed by professional people who have years of experience handling different types of assets. They are a group of dedicated fund managers that handles all financial decisions based on the performance & prospects available in the market.

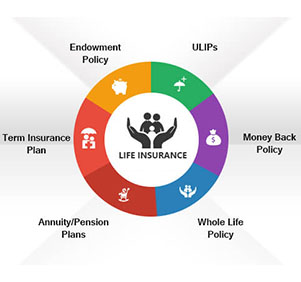

Term Life insurance Mutual funds are managed by professional people who have years of experience handling different types of assets. They are a group of dedicated fund managers that handles all financial decisions based on the performance & prospects available in the market.

Whole Life Policy Mutual funds are managed by professional people who have years of experience handling different types of assets. They are a group of dedicated fund managers that handles all financial decisions based on the performance & prospects available in the market.

Endowment Plany One main difference that Endowment Plans offer from term plans is the Maturity Benefit. This type of plan pays out sum assured along with profits under both scenarios - death & survival. The profits that are availed in such plans are the result of investment in equities & debt.

Looking for Investing in a Life Insurance product? But not sure exactly how it works? Mutual funds are managed by professional people who have years of experience handling different types of assets. They are a group of dedicated fund managers that handles all financial decisions based on the performance & prospects available in the market.

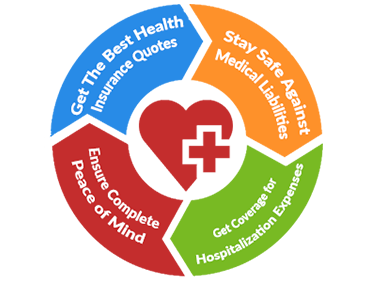

Life insurance is of significant importance if you wish to protect your family or dependents from any economic hardship in your absence Single Even if you have no immediate dependents relying on you financially, it doesn't mean that you don’t need a life insurance. There are many costs that you need to factor in and which needs additional income to fulfill them.

Family

Unexpected passing of an individual leaves a lot of void and the surviving members are left to cope with a lot of stress and trauma. And no matter what, expenses never ceases to exist; it just piles on- be it rent, childcare expenses, loans, etc. In such scenario, loss of income would cause an immediate financial hardship and your loved ones are left struggling. Nobody wishes this upon their family, hence life insurance needs to be seriously considered.

There are many categories of insurance policies available in the market today. Depending upon your needs and requirement your Financial Advisor will help you pick out the right one. You need to give complete details on your current financial status, along with your short term and long term goals, so that you Advisor is well-equipped to make a prudent choice for you. There are many categories like Retirement plans, Money Back Plans, Child Protection Plans, Endowment plans and much more. Remember, life insurance is a great tool for both protection and helping you save in a disciplined manner which eventually leads to creation of good corpus. With help of your advisor, fix your goals and align them with your financial objectives and lead a stress free life with a financially secured future..